income tax rate malaysia

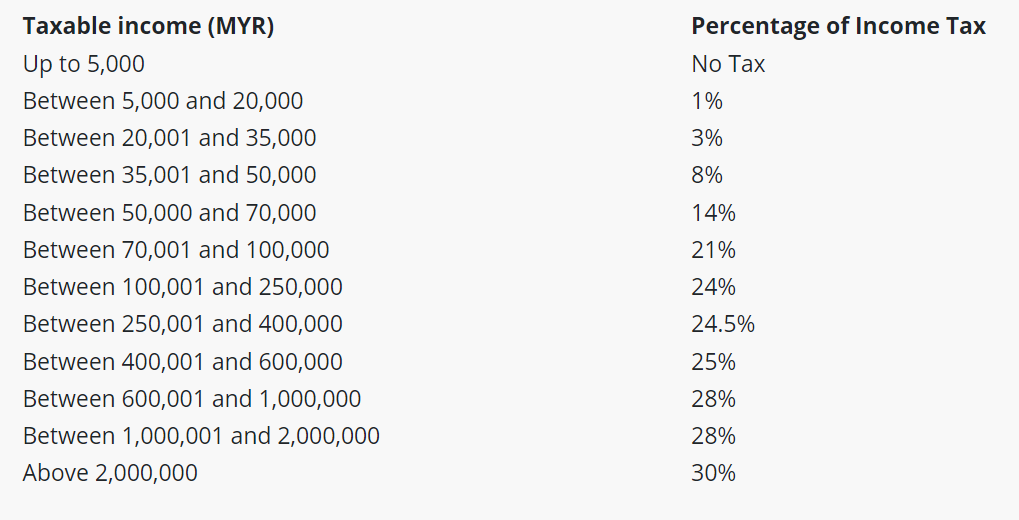

C Dividends interest or discounts. Taxable income band MYR.

Why No Wealth And Inheritance Tax In Malaysia R Malaysia

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

. On the First 2500. Malaysia has a territorial tax. If taxable you are required to fill in M Form.

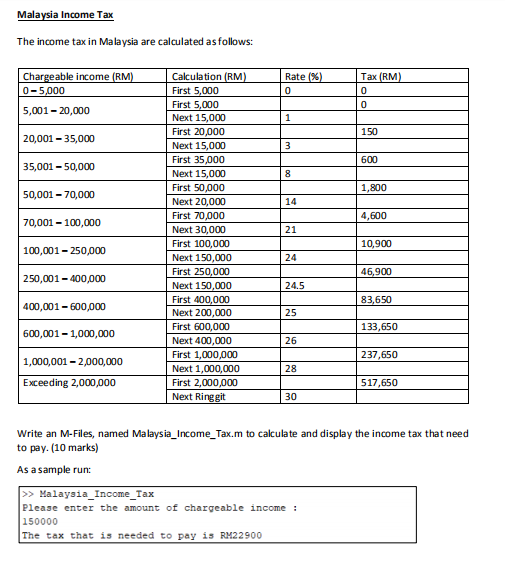

Calculations RM Rate TaxRM 0 - 5000. Malaysia has implementing territorial tax system. Assessment Year 2020 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income.

Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the. A non-resident individual is taxed at a flat rate of. 13 rows 30.

Your tax rate is calculated based on your taxable income. The deadline for filing income tax in Malaysia also varies according to what type of form you are. To put this into context if we take the median salary of just over 2000 MYR per month⁴ a resident would pay.

12 rows Chargeable Income. Both residents and non-residents are taxed on income accruing in or derived from Malaysia. A Gains profit from a business.

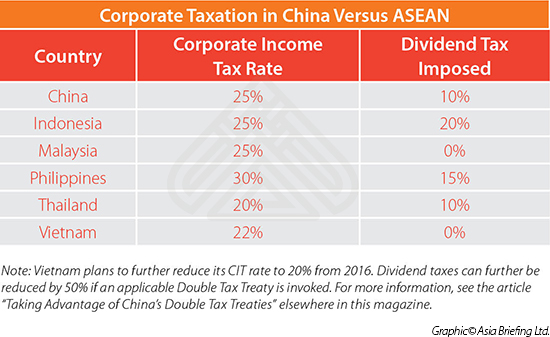

An effective petroleum income tax rate of 25 applies on income from. The standard corporate income tax rate in Malaysia is 24 for both resident and non-resident companies which gain income within Malaysia. Tax Rates for Individual - IncomeTaxMY.

However the blended tax rate is much lower for most residents. However there are exceptions for certain. The following list illustrates the income tax rate for each taxable income group from the year 2010 assessment onwards.

Foreign income remitted into Malaysia is. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia.

Taxable income band MYR. Based on this amount your tax rate is 8 and the total income tax that you must pay. Additionally the tax rate on those earning more than RM2 million per year has been increased from 28 to 30.

Tax reliefs and rebates There are 21 tax reliefs available for individual. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. B Gains profit from employment.

Tax is imposed annually on individuals who receive income in respect of. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Total income - tax exemptions and reliefs chargeabletaxable income.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30. Taxable income band MYR.

The Malaysian corporate standard income tax rate is 24 applicable to resident or non-resident companies that earn revenue inside Malaysia. You can check on the tax. Tax Rates 2020 for Individual - IncomeTaxMY.

Malaysia Residents Income Tax Tables in 2020. So the more taxable income you earn the. Malaysia Residents Income Tax Tables in 2022.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. A tax planner tax calculator that calculate personal income tax in Malaysia.

These Companies May Be Subject To The One Off 33 Prosperity Tax The Edge Markets

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

This Income Tax Calculator Shows What You Owe Lhdn Ringgit Oh Ringgit

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

Personal Income Tax And Top Personal Marginal Income Tax Rate 2009 Or Download Scientific Diagram

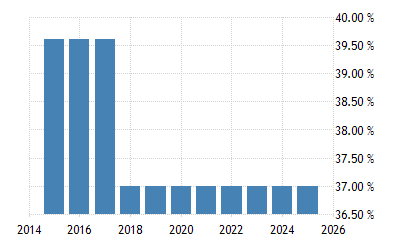

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Asiapedia Corporate Taxation In China Versus Asean Dezan Shira Associates

Ks Chia Associates Budget 2021 Tax Incentive Companies Relocating To Malaysia Facebook

Income Tax Formula Excel University

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

United States Personal Income Tax Rate 2022 Data 2023 Forecast

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Solved Malaysia Income Tax The Income Tax In Malaysia Are Chegg Com

Tax Guide For Expats In Malaysia Expatgo

The State Of The Nation Individual Tax Cuts Still Possible In Budget 2023 Despite Likely Silence On Gst The Edge Markets

Personal Income Tax Asean Asean Business News

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets